SCORE YOUR EXECUTION

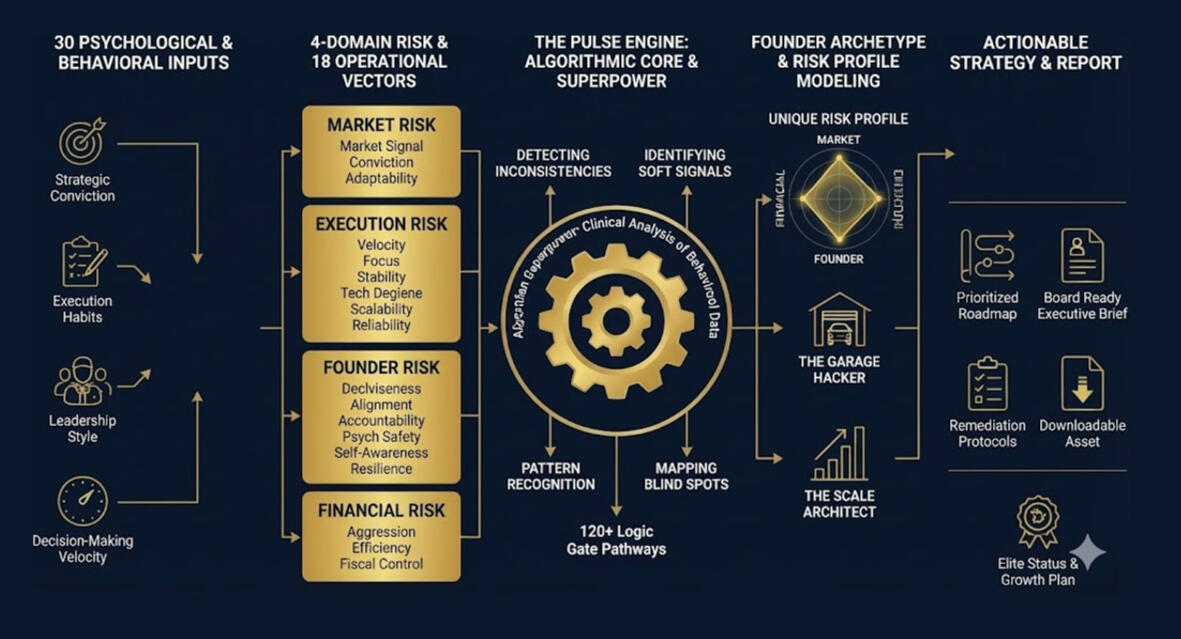

The only 18-vector engine that measures Execution Potential. Move beyond backward-looking metrics and prove your investability with forward-looking data

We analyze the hidden pulse of your venture across 18 critical dimensions

From Capital Efficiency and Team Velocity to Market Resilience and Technical Debt.Stop Guessing. Start Rating

From Data to Strategy

Transformation doesn't have to be complicated. We have condensed months of consulting work into a frictionless, 10-minute workflow. From your raw inputs to a board-ready roadmap, this is the most direct path to operational clarity for time-constrained founders.

1- Diagnostic

2- Engine

3- Report

How does it work?

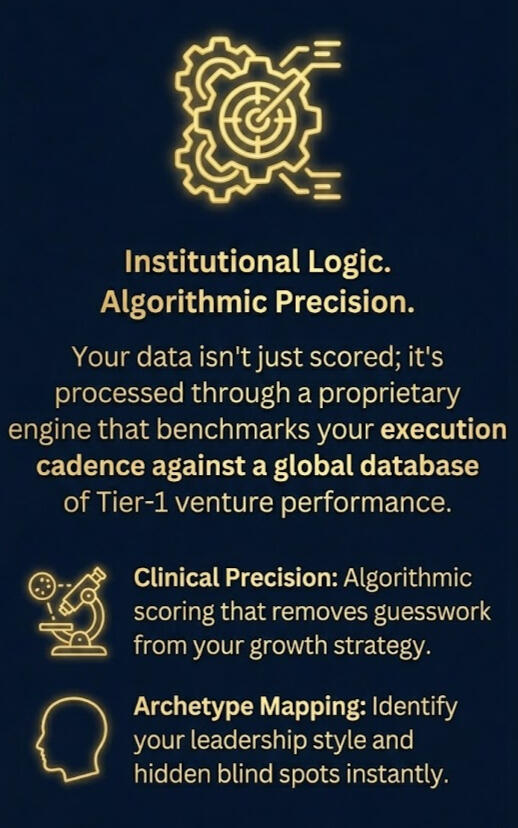

This isn't just a quiz; it’s an engine. We analyze your 30 unique inputs across 18 distinct operational vectors - processing over 120 logic pathways to map your specific risk profile.By cross-referencing behavioral signals with hard execution metrics, we uncover the invisible friction points that standard data misses.

Pulse Diagnostic (Free)

And will always be

Baseline metrics to identify operational friction.

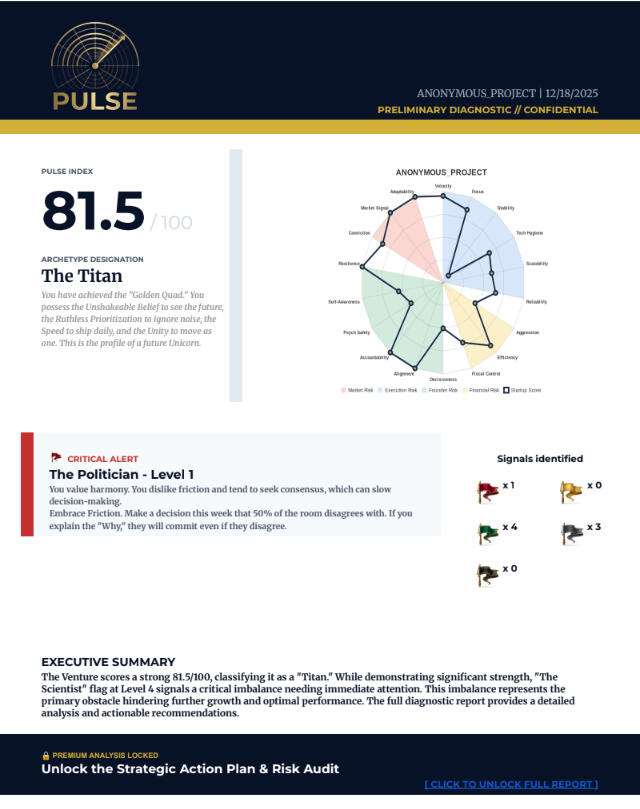

18-Vector Core Audit: High-level scoring across all primary execution categories.

Archetype Classification: Identify your current operating model and venture profile.

Red/Green Flag Indicators: Immediate identification of your critical failure point.

10 Min assessment - 30 single/Multiple choices questions

Text

Pulse Executive

Premium due diligence. A fraction of the cost

Tactical execution intelligence

Move your venture from functional to elite.

10-Page Executive Deep-Dive: A high-signal architectural breakdown of your 18-vector execution footprint and hidden liabilities.

Behavioral Mirror & Archetypes: Critical analysis of your leadership style, including "Fake" trait identification and psychological blockers.

Four-Pillar Risk Assessment: Granular scoring and analysis of Market, Execution, Founder, and Financial risk categories.

Remediation Plan: Prioritized tactical protocols (e.g., Decision Deadlines, Weekly Win Systems) to fix identified Red Flags.

Downloadable Board Asset: A professional summary designed to bridge the trust gap during VC due diligence and institutional reviews.

Coming Soon

About the Architect

Built at the intersection of Institutional Audit and Venture Reality.The Pulse Project was architected by a 3x Founder with a decade of experience in Financial Audit and Risk Modeling.The Philosophy: In finance, we are taught that 'past performance is not indicative of future results.' Yet, VCs still invest based on history.

We built the Pulse to fix this flaw.By combining institutional-grade risk models with the operational realities of a building your own company, we created the first Forward-Looking Diagnostic.We don't care who you were five years ago; we measure how you execute today.

Contact Us

© Pulse. All rights reserved.